chanel bag usa tax refund | The Bag Lover’s Guide to Value Added chanel bag usa tax refund How Much: 8%. Who: All non-Swiss residents. Which Stores: Stores do not have to receive special government designation to sell to shoppers looking for a VAT refund and most shops (especially high-end fashion retailers or boutiques) in tourist-heavy areas . See more WARNING: TO PREVENT FIRE OR SHOCK, DO NOT EXPOSE THIS UNIT TO RAIN OR MOISTURE. DO NOT USE THIS UNIT’S PLUG WITH AN EXTENSION CORD OR IN AN OUTLET UNLESS ALL THE PRONGS CAN BE FULLY INSERTED. DO NOT OPEN THE CABINET. THERE ARE HIGH-VOLTAGE COMPONENTS INSIDE. ALL SERVICING .

0 · This is what happened when I declared all my designer

1 · This is what happened when I declared

2 · The Bag Lover’s Guide to Value Added Tax Refunds in the

3 · The Bag Lover’s Guide to Value Added

4 · Issue With Getting Back Import Tax After Returning

5 · How To Declare Your Hermès Purchases from Paris and Still

6 · How To Declare Your Hermès Purchase

7 · Hi! This is my first Chanel item, I bought it on the US but I

8 · Guide To Tax Refund In The United States

9 · Guide To Tax

10 · Fragrance Beauty

11 · Fashion

12 · Can You Still Save Money From Buying Your Chanel Classic

13 · Can You Still Save Money From Buying

Replacement remote control for Canon LV-7295 with all functions of original one. It replace each button of original remote control. You will receive it with installed functions of original remote. Just put batteries and it is ready-to-use. 12 months guarantee.Download drivers, software, firmware and manuals for your Canon product and get access to online technical support resources and troubleshooting.

This is what happened when I declared all my designer

How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist VISA Which Stores: Stores do not require a special designation to sell to customers looking for a . See more

This is what happened when I declared

How Much: 20% if processed by the shopper; less if processed by the store or an agency hired by the store, who will deduct fees. Who: Residents of non-EU countries visiting the UK on a tourist visa, or EU residents who can prove they’re leaving for at least 12 . See moreHow Much: 19% if processed by shopper; convenience agencies at the airport can Quicken and simplify the process, but they will knock your refund down to around 12% with their fees. Who: . See more

How Much: 8%. Who: All non-Swiss residents. Which Stores: Stores do not have to receive special government designation to sell to shoppers looking for a VAT refund and most shops (especially high-end fashion retailers or boutiques) in tourist-heavy areas . See moreHow Much: 22% if processed by the shopper; convenience agencies at the airport can Quicken and simplify the process, but they will knock your refund down several percentage points with their fees. Who: Non-EU residents visiting the country as temporary . See more Total cost in US: ,800 + ,080 (sales tax approx 10%) = ,880. Total cost in Europe: ,162 (incl. VAT refund & US duty) Savings: ,880 – ,162 = 8 or 6%

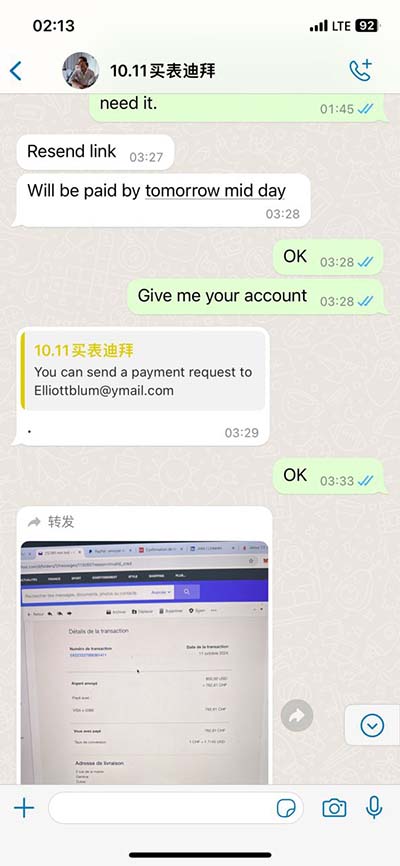

With how quickly the US and Europe exchange information now about your purchases through tax refunds, not declaring and then getting caught could have some pretty serious consequences- .

how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a . Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly. .

The Bag Lover’s Guide to Value Added Tax Refunds in the

The Bag Lover’s Guide to Value Added

where to buy chanel mini coco

Please note, your return may take 7 to 10 business days to arrive at the CHANEL warehouse, up to 14 business days to process and an additional 7 business days to appear on your statement .

This is my first Chanel item, I bought it on the US but I’m not from the US so I can ask for a tax refund. I went to ask for the refund but they ask to keep the original ticket so I decided not to, .

When you go to the United States you have to pay sales tax if you’re buying Chanel, Louis Vuitton, Celine, Hermes or Dior Bags. This post is about how to claim sales tax . So recently I purchased a Chanel bag from Japan for over 00. After the seller shipper sent the package I received a message that I have to pay import fee. I paid it shortly .

You can get tax-refund. Many fashionista’s purchases their favorite brands like Chanel, Louis Vuitton, Dior, Hermes, Celine in Europe. Why do people shop designer brands in Europe? . If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund.

Total cost in US: ,800 + ,080 (sales tax approx 10%) = ,880. Total cost in Europe: ,162 (incl. VAT refund & US duty) Savings: ,880 – ,162 = 8 or 6% With how quickly the US and Europe exchange information now about your purchases through tax refunds, not declaring and then getting caught could have some pretty serious consequences--a fine that will likely be higher than the original duties, and/or confiscation.how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport.

Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly. In the United States right now, that same bag costs 00 plus tax in your state (9.5% in my state). The total is ,840.50.Please note, your return may take 7 to 10 business days to arrive at the CHANEL warehouse, up to 14 business days to process and an additional 7 business days to appear on your statement as a refund. Should you have any questions or need further assistance, please contact CHANEL Client Care at 1.800.550.0005 or via email at customercare.us . This is my first Chanel item, I bought it on the US but I’m not from the US so I can ask for a tax refund. I went to ask for the refund but they ask to keep the original ticket so I .

When you go to the United States you have to pay sales tax if you’re buying Chanel, Louis Vuitton, Celine, Hermes or Dior Bags. This post is about how to claim sales tax back in the United States when you’re a tourist just like when you go shopping in Europe. So recently I purchased a Chanel bag from Japan for over 00. After the seller shipper sent the package I received a message that I have to pay import fee. I paid it shortly after and when I received the bag, it was not as described and I returned the bag back to seller.You can get tax-refund. Many fashionista’s purchases their favorite brands like Chanel, Louis Vuitton, Dior, Hermes, Celine in Europe. Why do people shop designer brands in Europe? Well, besides that the prices are usually better, it’s also a famous place to travelling.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund.

Total cost in US: ,800 + ,080 (sales tax approx 10%) = ,880. Total cost in Europe: ,162 (incl. VAT refund & US duty) Savings: ,880 – ,162 = 8 or 6%

With how quickly the US and Europe exchange information now about your purchases through tax refunds, not declaring and then getting caught could have some pretty serious consequences--a fine that will likely be higher than the original duties, and/or confiscation.how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport.

Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly. In the United States right now, that same bag costs 00 plus tax in your state (9.5% in my state). The total is ,840.50.Please note, your return may take 7 to 10 business days to arrive at the CHANEL warehouse, up to 14 business days to process and an additional 7 business days to appear on your statement as a refund. Should you have any questions or need further assistance, please contact CHANEL Client Care at 1.800.550.0005 or via email at customercare.us . This is my first Chanel item, I bought it on the US but I’m not from the US so I can ask for a tax refund. I went to ask for the refund but they ask to keep the original ticket so I .

When you go to the United States you have to pay sales tax if you’re buying Chanel, Louis Vuitton, Celine, Hermes or Dior Bags. This post is about how to claim sales tax back in the United States when you’re a tourist just like when you go shopping in Europe. So recently I purchased a Chanel bag from Japan for over 00. After the seller shipper sent the package I received a message that I have to pay import fee. I paid it shortly after and when I received the bag, it was not as described and I returned the bag back to seller.

Issue With Getting Back Import Tax After Returning

How To Declare Your Hermès Purchases from Paris and Still

Specifications. DLP Projector LV-WX300/LV-X300/LV-S300. Outline of product. This device is a series of DLP portable projectors each featuring a brightness of 3000 lumens in a compact body that weighs only 2.5kg. User can select a projector from three different types depending on the image resolution and usage applications.

chanel bag usa tax refund|The Bag Lover’s Guide to Value Added