bain lv takeover | bain capital takeover bain lv takeover LV discloses it is in exclusive takeover talks with Bain Capital, choosing the firm over bidders including rival mutual Royal London

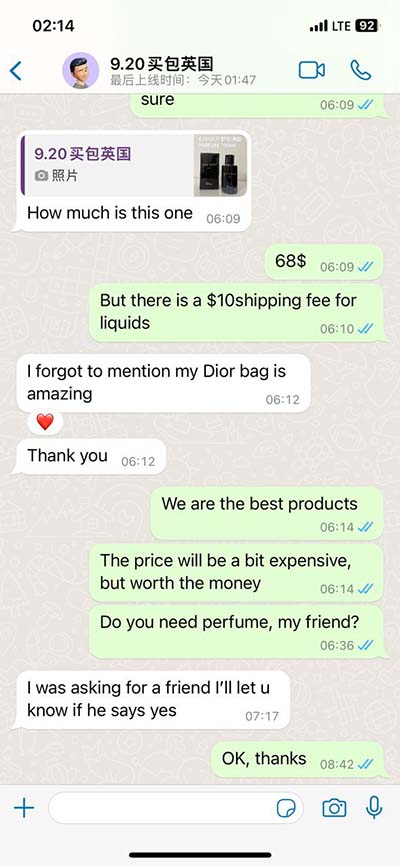

REAL VS CLONE | AMOUAGE REFLECTION MAN VS DUA FRAGRANCES DESERT REFLECTION FRAGRANCE REVIEW. TroyD247Mall. 21.1K .

0 · lv takeover

1 · lv members rejected bain capital

2 · lv members banned from bain capital

3 · lv bain capital sale

4 · lv bain capital problems

5 · lv bain capital news

6 · bain capital takeover

7 · bain capital lv

OMEGA. Description : « De Ville chronographe », vers 1960 Bracelet-montre d’homme en acier, boîtier rond (35mm), cadran argenté à index bâtons appliqués et deux compteurs secondaires, mouvement mécanique (calibre 860), fond vissé, bracelet articulé en acier avec boucle réglable non d’origine. Référence 145.017.

lv takeover

Members of LV= have rejected selling the insurance mutual to US private equity firm Bain Capital for £530m. The sale of LV= to Bain Capital had been controversial, drawing .Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best .The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 . The life insurance company this morning announced it was giving up its mutual status and is selling its savings & retirement and protection businesses to Bain Capital, the .

Members of LV, one of the UK’s oldest mutually owned life insurers, have rejected a takeover by private equity group Bain Capital, in a vote hailed as a “victory for mutuality” by . LV discloses it is in exclusive takeover talks with Bain Capital, choosing the firm over bidders including rival mutual Royal London Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its .

The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 and formerly known as Liverpool Victoria, would lose its mutual status if the . Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its . Insurer LV names new chair after failed Bain takeover. Former Barclays banker Simon Moore to replace Alan Cook, who stepped down earlier this year. LV, formerly called . The planned sale of LV to Bain Capital has set alarm bells ringing among customers, members and staff. If it goes ahead, the £530m deal will see one of Britain's oldest .

LV announced last week that members would receive £100 each to approve the takeover by US group Bain, with more for those holding eligible with-profits policies. The deal’s . Members of LV= have rejected selling the insurance mutual to US private equity firm Bain Capital for £530m. The sale of LV= to Bain Capital had been controversial, drawing criticism from . The life insurance company this morning announced it was giving up its mutual status and is selling its savings & retirement and protection businesses to Bain Capital, the private equity firm, for £530m. The deal follows the sale, for a total of £1.1bn, of LV='s general insurance business to Allianz of Germany last year.

Members of LV, one of the UK’s oldest mutually owned life insurers, have rejected a takeover by private equity group Bain Capital, in a vote hailed as a “victory for mutuality” by the MP that. LV discloses it is in exclusive takeover talks with Bain Capital, choosing the firm over bidders including rival mutual Royal London

Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its status as a.

Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its status as a mutual.

The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 and formerly known as Liverpool Victoria, would lose its mutual status if the sale goes through.

LV announced last week that members would receive £100 each to approve the takeover by US group Bain, with more for those holding eligible with-profits policies. The deal’s supporters have until. The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 and formerly known as Liverpool Victoria, would lose its mutual status if the sale goes through.This follows the outcome of the vote on the acquisition of the LV= business by Bain Capital at the Special General Meeting earlier today, with the result that the transaction with Bain Capital will no longer proceed. Members of LV= have rejected selling the insurance mutual to US private equity firm Bain Capital for £530m. The sale of LV= to Bain Capital had been controversial, drawing criticism from .

The life insurance company this morning announced it was giving up its mutual status and is selling its savings & retirement and protection businesses to Bain Capital, the private equity firm, for £530m. The deal follows the sale, for a total of £1.1bn, of LV='s general insurance business to Allianz of Germany last year.

lv members rejected bain capital

Members of LV, one of the UK’s oldest mutually owned life insurers, have rejected a takeover by private equity group Bain Capital, in a vote hailed as a “victory for mutuality” by the MP that. LV discloses it is in exclusive takeover talks with Bain Capital, choosing the firm over bidders including rival mutual Royal London

Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its status as a. Mark Hartigan, chief executive of LV=, said that a takeover by Bain Capital marked the "best financial outcome" for its members. The £530m deal would see the company lose its status as a mutual. The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 and formerly known as Liverpool Victoria, would lose its mutual status if the sale goes through. LV announced last week that members would receive £100 each to approve the takeover by US group Bain, with more for those holding eligible with-profits policies. The deal’s supporters have until.

The proposed £530m takeover by Bain Capital has led to a backlash. LV=, founded in 1843 and formerly known as Liverpool Victoria, would lose its mutual status if the sale goes through.

ysl water stain glow lip stain 207

Olde English 800 is a brand of American malt liquor brewed by the Miller Brewing Company. It was introduced in 1964, and has been produced by the company since 1999. It is available in a variety of serving sizes .

bain lv takeover|bain capital takeover